Google antitrust lawsuit has created an intense discussion about whether Google’s dominance in the digital advertising industry would remain the same. Google is the biggest online advertiser with more than 27 percent of the revenue shared globally. It has beaten Meta by approximately $33 billion in the year 2024, further solidifying its position as a tech giant in the ad tech industry.

It could be inferred that this was Google’s most ignorant phase where it seemed to be enjoying its invincibility in the digital advertising industry and became ignorant somehow, started having hiccups with the unknown competitors. These are not search engine consoles or searchers built for online ads; rather, they are part of Google’s ad tech ecosystem.

These were the apps built for other purposes but they gained upon Google slowly to provide users a way to look for things that they would have otherwise searched on Google. TikTok, Facebook, Instagram, Quora, Reddit, Amazon, Walmart, Netflix, Hulu etc.

The post would explore how these platforms are disrupting Google’s model of online advertising and potentially challenging its monopoly.

Google’s current dominance in digital advertising

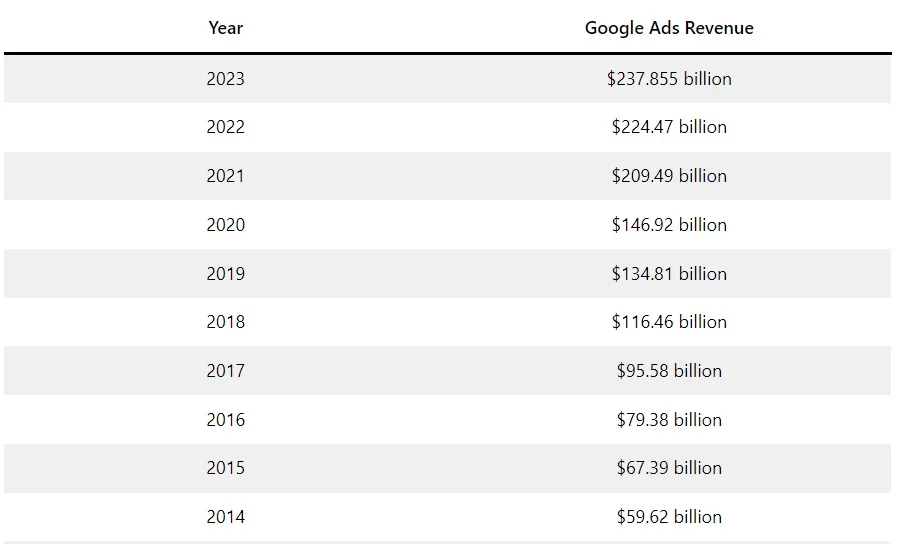

For 2023, the total ad revenue of Google was $224,473 billion, a significant figure in the debate over its alleged illegal monopoly in advertising technology and the ongoing antitrust violation discussions. which was more than that of the previous year, 2022 and 2021.

Google Ad Revenues in the light of the ongoing Google antitrust lawsuit are under examination by antitrust enforcers, emphasizing the challenges faced by the company.

The steady rate of increase for Google, which was 365.74 percent, has been observed which is a healthy sign for its ads business.

The top market share of Google online advertising remains a significant force, particularly as the antitrust case against Google unfolds. is coming from the pay-per-click (PPC) market, being 61.73 percent of the market share in the realm of search advertising, a figure that may be scrutinized in the antitrust case against Google.

For the customers, the results of the Google antitrust case could significantly impact the online advertising landscape. Google digital ads continue to be scrutinized under the lens of the ongoing antitrust suit, particularly whether Google is monopolizing the digital advertising market, leading to increased discussions among former Google employees. are always positive. 65 percent of the clicks are for buying keywords as compared to the organic results, which are only 35 percent.

Moreover, 75 percent of the users say that Google’s ads are informative and make their search easier in the context of the digital advertising market, which is crucial as Google faces scrutiny from antitrust enforcers. 43 percent of the users are inclined to buy the product when they see it running on Google digital ads, highlighting the effectiveness of search advertising.

Further stats from HubSpot and Lumio revealed that 58 percent of Millennials have made purchases through Google ads. Another 33 percent use Google ads on mobiles to increase their brand awareness via paid ads, a strategy that reflects the competitive nature of the ad platform market.

The shining results have come from Google’s advertising ecosystem, which includes AdSense, Adwords, Double Click, and its ad server technologies, despite the challenges posed by the former Google employees discussing the ad prices. Google Ad Manager, an ad server, is the current name for Google’s ad-serving platform which is perfect for users of Double Click for Publishers (DFP), especially as the company navigates the implications of the Google antitrust ruling.

The other effective tools that Google offers for marketers to help them grow with their ads are Google Keyword Planner, Google Analytics, Google Search Console, Google Business in the context of the Google antitrust suit is increasingly focused on the dynamics between publishers and advertisers. Profile, etc., is essential in the context of the Google antitrust ruling.

The rise of social media advertising

According to 2024 market stats, Facebook’s US ad revenues account for up to $33.68 billion in 2024, an estimate of 8.5 percent growth as compared to the previous year, indicating a shift in the ad platform dynamics. Facebook ads are considered to be one of the prime sources of its revenues, which is approximately 52.1 percent, highlighting its dominance as a tech giant in the digital advertising space.

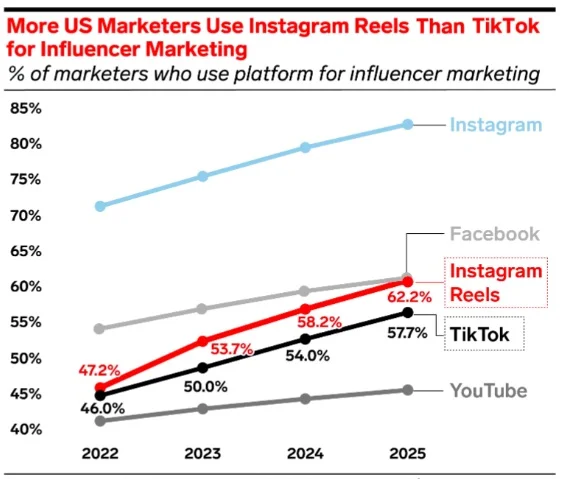

Instagram and TikTok reels are used for influencer marketers to generate ad revenues for these platforms, reflecting the broader trends in the digital advertising market. Almost 97 percent of the US influencers use Instagram for marketing purposes while 75 percent use Facebook for the same purpose.

As compared to Facebook, Instagram’s ad revenues in the US totaled up to $30.95 billion in the current year, which showed a 20.2 percent growth rate from the previous year, showcasing its strength in the ad tech sector.

Online product searches now take place on Facebook and Instagram as well. For example, when they have to search “office chairs”, they would go to Facebook buy and sell pages or directly to the Instagram search bar, utilizing various ad exchange platforms that are also being evaluated in the context of the ad tech antitrust trial.

Currently, Meta is number two, after Google when it comes to ad dominance, a situation that may change depending on the outcomes of the US antitrust investigations led by the DOJ’s antitrust division. However, Meta is losing its market share to Amazon, which is the biggest marketplace for products, raising concerns among regulators in the district court for the eastern district. The side ads on Amazon’s page also show suggestions once you have looked up a product, similar to strategies used in Google’s digital advertising market, which is currently under the scrutiny of the eastern district of Virginia.

A Forbes article of 2023 stated that the power of personalized ads cannot be ignored. People now prefer personalized and customized ads that would include user experiences and shopping behavior related to a product, which has implications for antitrust law discussions. In this way, online advertisers are able to create highly relevant and targeted ad campaigns for online navigators.

The same example applies to streaming platforms, such as Hulu. Once you stream a certain kind of content, it will suggest relevant ads to its customers. Moreover, Hulu charges as low as $500 for the advertisers to run their ads on the streaming platform, Forbes revealed, making it an attractive option in the competitive ad tech landscape.

One of the well-known ad campaigns for ALS (amyotrophic lateral sclerosis) research was run by the name “Ice Bucket Challenge”. The challenge was about people filming themselves when they were pouring ice water over their heads and throwing others the same challenge. It was shared on social media in 2014 and raised $115 million for ALS research, highlighting the power of viral campaigns in the ad platform landscape.

Why it became viral within no time, especially in a landscape influenced by the Google antitrust ruling? Because it was simple, included celebrities and influencers, such as Taylor Swift and Wendy Cheng aka Xiaxue (a Singaporean blogger and online TV personality), and had a measurable impact with a sense of accomplishment once completed.

The rationale for which advertisers are shifting budgets from Google to social media platforms is the use of sophisticated tools offered to advertisers, as they allege that Google maintains an illegal monopoly. However, it is mostly about where people spend most of their time, which is a key factor in the ongoing civil antitrust suit against Google. The visibility factor is high, and thus, ads are easily accessible to people.

Google online advertising needs to think of more viable ways in the presence of such tough competition, especially as the DOJ’s antitrust investigation unfolds. Google’s long-standing dominance is being challenged by a number of factors, including growing privacy concerns, technological breakthroughs in ad-blocking, the explosive growth of influencer marketing, and the development of artificial intelligence.

Streaming platforms as new ad giants

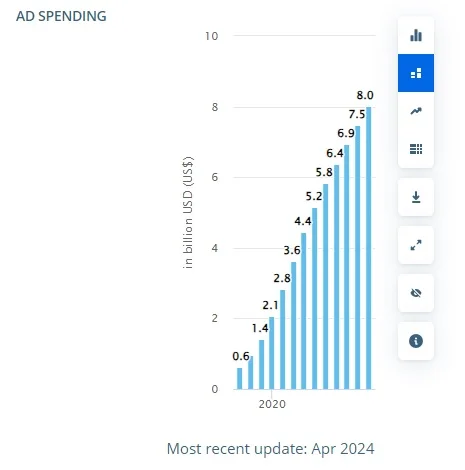

Viewers have switched to streaming subscriptions to Netflix, Hulu, and Amazon Prime to avoid ads while they are watching movies or shows on television. These platforms are now a huge market for online advertisers to gain leverage on, especially in light of the ongoing Google antitrust trial and the Justice Department’s scrutiny.

They provide a massive opportunity to engage viewers but with better versions of online ads. Some of them have tried using AI too. For instance, Hulu advertisers target ads to the users based on their age, gender, location, and interests which makes it easier for the publisher to position the ads well.

A similar strategy is used by Netflix where advertisers target some of the most popular content in the world to run their 10, 15, 20, 30, or 60-second ads, which could face scrutiny under the civil antitrust suit. The ads are related to dating services, financial services, etc., and are increasingly being analyzed in light of the US antitrust issues. It keeps in mind that romantic shows might be watched more by the age group 18-35, making it an effective targeting strategy and even memorable for online advertisers selling ads via Netflix.

Google Ads’ history starts from the 2000s, making it a significant player in the digital advertising market while maintaining its brand name and trust in the ad tech industry, despite the challenges posed by the antitrust case against Google. People are four times more likely to click on Google ads than any other platform ad. Google ads offer more visibility in the digital advertising market. and specialize in highly targeted campaigns that provide efficacy for the targeted users and their searched products through advanced ad auction strategies.

However, with aging Baby Boomers and Millennials, the new generations like Gen-Z and Gen-Alpha are shaping the way these younger people are searching for products online. They are more inclined to use social media platforms for checking out reviews and looking for web pages of the products, reflecting the changing dynamics in the ad exchange market amid the Google antitrust trial. Also, these generations use more streaming platforms like Netflix and Hulu which is raising serious questions on Google’s authority and market position in the online ad industry.

Challenges Google is facing

Google antitrust lawsuit argued that the US district court is narrowly focusing on the actual issue of Google digital ads and is not taking into account the true scale of the online ad industry’s competition.

Mark Israel, an economist, explained on behalf of Google that the judge is solely focusing on “open web display advertising”, which is a term for ads that show on web pages when Google is open on desktops and laptops.

He was of the view that online advertising has shifted its interest to social media platforms lately. For the year 2022, Google had only a 10 percent market share in the US for search advertising, which went down from the 15 percent that was set a decade ago, prompting scrutiny from the department of justice.

Israel again tried to stress the fact that the judge, Judge Leonie Brinkema, was only talking about Google’s inflating prices for the online ad runners and publishers in the ongoing Google antitrust case. The allegations revealed that Google keeps 36 cents on one dollar for each ad while having 91 percent of the control, over the publisher’s ad to itself, a focal point in the antitrust trial.

Israel denied the fact and asked the judge to take into account Google’s accuracy in matching the ads to the consumer, for which the price setting is done right amidst such intense competition in the presence of social media platforms.

As the proceedings of the Google antitrust lawsuit were conducted, Israel also clarified that recently, Google’s charges have dropped to 31 or 32 percent from the day the company noticed competitors charging high rates for the same task. Yet, the industry average for these charges is 42 cents per dollar for online ads of the publishers.

The complaint filed against Google is about the complex programming that Google uses for advertising including the bidding and targeting system that helps determine how the online ads are bought and sold. The allegations became stronger as Google made acquisitions to waive off the competition and maintain its hold in the said market as well as its supply chain.

According to the judge, Google uses its unchallenged authority in the digital ad ecosystem, bidding on behalf of the advertisers for the sake of owning the platform itself, a matter of interest for the justice department. In this way, Google makes more money and the publishers make less.

Google responded to the judge that the company is struggling against the more “messy and competitive space” now which includes The Trade Desk, Facebook, Amazon, TikTok, and Netflix. The third-party exchanges and the existing degree of interoperability have become more time-consuming and backbreaking work, raising concerns in the ongoing antitrust trial. As a result, Google clarified that it could otherwise produce adverse effects for the advertisers in the form of “invalid traffic and brand-safety risks”.

The future of digital advertising

A LinkedIn article published in 2024 gave insights into the way social media is becoming the “king of advertising”. More than 5 billion people on the entire planet use social media these days, which is 61 percent of the world’s population.

An estimated 19 percent of a firm’s advertising budget now goes into social media ads, which is almost equal to TV ad spending, highlighting the shift towards digital and Google ad tech. Hence, the growing influence of social media and streaming in the ad market is evident.

The complexity of Google’s antitrust case is more conspicuous with the incoming AR (augmented reality) advertising, as it complicates the landscape for Google ad tech. It is a form of digital marketing that makes use of AR/VR technology for interactive and engaging consumer experiences. For example, Teads partnered with Marcolin on an AR campaign for GUESS eyewear that gave online users a “Try-on” feature, showcasing innovative ad platform strategies.

Google antitrust lawsuit puts further questions on Google’s next strategy for online ad market and how Google should proceed upon it in the future to stay competitive. With the dynamic nature of the internet and its users’ needs, Google could rely on trial-and-error strategies and see which tactics work the best.

Wrapping Up

Google antitrust lawsuit is an example that there comes a time for any giant tech company in the world when it is tested hard on the strategies that have worked for them for decades. Google had been a dominant market player for the last three decades but now with constantly changing market variables, Google’s survival in the online ad industry is jeopardized.

However, there is always a potential for a more balanced competition as social media and streaming platforms continue to rise. There still remains a chance for Google to evolve and re-position itself.

FAQs

Q: What is the Google antitrust lawsuit about?

A: The Google antitrust lawsuit involves the U.S. Department of Justice suing Google for monopolizing the digital advertising market. It accuses Google of controlling ad prices and limiting competition among advertisers and publishers.

Q: How does the antitrust trial affect advertisers?

A: The antitrust trial may impact advertisers by potentially lowering ad prices and increasing competition in the digital advertising industry. If the court finds in favor of the plaintiffs, it could lead to changes in how Google operates its ad tech tools.

Q: What are the main allegations against Google in this antitrust case?

A: The main allegations against Google include violating antitrust laws by maintaining a monopoly over the technology used to buy and sell ads. The lawsuit claims that Google has created a system that disadvantages rival ad tech companies.

Q: What could be the consequences if Google loses the antitrust trial?

A: If Google loses the antitrust trial, it may face significant changes to its business practices, including potentially being forced to divest certain assets. This could lead to increased competition and lower ad prices in the digital advertising market.

Q: How does the Google antitrust ruling impact publishers?

A: A ruling against Google could positively impact publishers by allowing them to negotiate better ad deals and access a wider range of ad tech tools, thus enhancing their revenue potential in the digital advertising landscape.

Q: What has Google said regarding the antitrust allegations?

A: Google says that the allegations are unfounded and argues that it operates in a competitive environment where advertisers have numerous choices. Google maintains that its practices benefit both advertisers and consumers.

Q: Who is involved in the Google antitrust case besides Google?

A: The case involves the U.S. Department of Justice, which is leading the lawsuit, as well as various ad tech companies and competitors that have been affected by Google’s alleged monopolistic practices.

Q: What are the broader implications of this antitrust case for the digital advertising industry?

A: The broader implications include potential regulatory changes that could reshape the digital advertising landscape, affecting how companies use and sell ads. It may set a precedent for how tech giants are regulated in the future.

Q: How are ad prices expected to change if Google is found guilty of antitrust violations?

A: If Google is found guilty, competition could increase, leading to lower ad prices as advertisers would have more options and leverage in the market. This could create a more balanced environment for advertisers and publishers alike.