Business

Google Antitrust Case Alleging Monopoly In Advertising Technology Continues With Its Defense

Google antitrust case continues with Google’s opening as a defense against the allegations of monopoly in advertising technology. The case started on Friday with a testimony saying that the online advertising industry is far more complex and requires greater competitive steps.

The picture painted by the federal government for the online advertising industry’s competitiveness is meager. Scott Sheffer, vice president for global partnerships at Google said, “The industry has been exceptionally fluid over the last 18 years”. He was presented as the first witness in the Google antitrust in federal court in Alexandria.

Why Google antitrust case was launched?

The launch of the case was based on the allegation that Google exploits the technology that facilitates the buying and selling of online ads as online users see them. The Justice Department and a coalition of states contended that Google had been building this illegal advertising monopoly for years.

Google, on the other hand, defended its side by saying that the government only focuses on the ads that appear in rectangular shapes on the top and right-hand side of the webpage. These should be considered as mere narrow types of ads.

Google’s opening statement in defense

In its opening statement, Google’s lawyers emphasized that the Supreme Court is seeing one side of the picture and Sheffer described the problem as being more complicated. The rapidly emerging technology might need to be changed due to the increased risk or unintended consequences.

According to Google, the competition from social media and other platforms might be ignored if only these ads were taken into account. Defining the online advertising market so narrowly would be a risk as Amazon and other related streaming platforms are also now considered major competitors in this industry.

Reaching online consumers has become far more intricate than before as Gen-Z and Gen-Alpha’s needs must be defined separately. The detailing in ways that were acceptable a decade ago is now no longer considered pertinent.

Justice Department’s stance on the case

The lawyers of the Justice Department asked the witnesses to testify for two weeks before resting the case on Friday afternoon. The automated ad exchanges and conduction of actions should be detailed in ways that consumers must see and placed in front of them in the same way for the court to have a profound look at the matter.

The department was of the view that Google’s monopoly in advertising is finessed in subtle ways that provide benefit to Google only with a clear exclusion of its would-be competitors. The strategy facilitates an apparent prevention of the publishers from making money that they would have made otherwise from selling the same ads.

In the proceedings of the Google antitrust, it was estimated that Google’s technology helps the firm make 36 cents per ad from which a particular purchase is made, which occurs in billions every single day. This was estimated after keeping in account all facets of an ad transaction.

Testimony from executives

Several executives at media companies like Gannett that own USA Today and News Corp., along with the Wall Street Journal and Fox News confirmed that Google dominates the online ad landscape. Its technology helps the publishers to sell and that is only strategized by Google in a way that they tie together the ads for the user to have easy access to them.

In Friday’s testimony, Sheffer added that Google’s tools have evolved over the years and provide malware for fraud protection to publishers and online advertisers.

In this case, the government stressed that since the complaint was filed last year to break the dominance as Google keeps the portion of selling off from the ads showing on the pages, the results are still not satisfactory.

The trial is still ongoing after it began on 9 September for the search engine’s illegal monopoly.

About The Author

Business

Everyday Low Price Walmart Strategy Fuels Strong Third-Quarter Growth

Everyday low price Walmart strategy helped the firm escalate its third-quarter sales and attracted shoppers looking for fair cuts and convenient spending.

This third-quarter sales growth raised the outlook of the retail giant and its shares rose to 4 percent in premarket trading on Tuesday.

What is Walmart’s financial performance in the third quarter?

Walmart’s financial performance is marked by a net income of $4.58 billion or 57 cents per share for three months ending on 31 October. When compared to its previous net income, which was $453 billion or 6 cents per share during the last year, Walmart’s net income Q3 has grown a massive growth graph.

The hit strategy, EDLP Walmart, supported it in gaining 5.5 percent sales, accounting for $169.59 billion; a great rise from one year ago number, which was $160.8 billion. It has easily beaten projections made by market analysts.

Details of Walmart’s third-quarter sales success

Comparable store sales of Walmart, which include both online and in-store for the past 12 months, saw a rising graph as well in the United States. It was an evident jump from 3.8 percent (first quarter) and 4.2 percent (second quarter).

An interesting feature of Walmart low cost strategy is its broad-based strength that is applicable to its all categories, both physical and digital channels the company confessed.

Based in Bentonville, Arkansas, Walmart’s e-commerce growth experienced 27 percent surge as compared to 21 percent in the second and first quarters of the same year.

Consumer spending, inflation, and government policies

Walmart understood thoroughly the holiday shopping season outlook and capitalized well on it. It knew that people were looking to ‘shop till they drop’ and for that, EDLP Walmart strategy is the best answer for consumer spending trends 2024 like online shopping, average order value, loyalty and rewards, buy now and pay later, spending with relevance to income and cross-shopping, etc.

Industry experts predicted that consumers want to spend more this year despite the sales did not to be meeting last year’s spending levels in the United States.

Post-pandemic inflation impact was observed with 20 percent inflation, which, when compared with the prices three years ago, gave an overall outlook of the American economy and its people’s spending. It was a solid reason for the US voters to ask for Donald Trump again in the White House.

Several US citizens complained about how inflation and household budgets have constrained their spending. Still, strong spending continued despite great US economic growth drivers and gave a boost to the US economy.

Retail sales grew by 0.4 percent from September to October, which was a huge increase from the previous month’s sales, told by the Commerce Department on Friday.

Walmart would also have to look into Trump’s proposed tariffs impact. Trump has pledged that he would put a 60 percent tariff on all goods imported from China and 20 percent on all goods imported from the rest of the world.

What are Walmart’s fiscal year projections?

Walmart’s fiscal year projections include earnings per share ranging from $2.42 to $2.47. It would be an increased figure from August’s projections, which were $2.35 and $2.43.

According to FactSet, industry analysts foresee it to be $2.45 per share.

What is Walmart low cost strategy?

EDLP Walmart strategy has been the winner all the way since its low prices on a wide range of everyday goods have won its customers. It has helped in keeping low operational costs and a better-optimized supply chain.

Its in-house brands like Great Value and Equate give cheaper alternatives to other brands for which customers hail low price Walmart strategy.

What is Walmart’s strategy for success?

One-stop shopping for every petty need that the customers have is the best aspect of the everyday low price Walmart strategy. From needles to furniture of the house, Walmart’s strategy has won hearts for years.

EDLP Walmart strategy has the lowest prices that customers, even if wanted to, could never find anywhere else. It has not only attracted customers but also built trust and loyalty. It is a tailored shopping experience for every customer according to their preferences so that with their increased engagement and satisfaction, they could save more.

This is what Walmart has been winning limitlessly. With the Walmart Rewards program, they get additional savings each time they shop and even for their future purchases.

Walmart low cost strategy is boring but reliable. The idea of ’economies of scale’ was first introduced by Adam Smith in the late 19th Century but Walmart has been applying it for years now.

Big retail companies like Walmart can easily cut their costs and offer customers the lowest possible prices by negotiating better prices with their suppliers, utilizing their facilities, and lowering prices on the distribution side.

With inflation on the rise, even affluent consumers have started shopping at Walmart so that their household spending remains within budget, a model that even Amazon could not fully copy, and has proven solid after decades.

Wrapping Up

Walmart hasn’t made any drastic changes to its low-cost strategy since it wanted to rely more on its tried-and-tested model, which has worked wonderfully in every era. It seems a viable and relevant strategy that has proven a great survival gambit over the years.

It is an excellent learning experience for other retailers who should not go after shiny or innovative approaches and adopt a more cautious business tactic if they are looking for a long-term stay in the market.

FAQs

1. What is Walmart’s financial performance in the third quarter of 2024?

Walmart reported a net income of $4.58 billion, or 57 cents per share, for the three months ending October 31, 2024. This marks a significant increase from $453 million, or 6 cents per share, during the same period last year.

2. What is the “Everyday Low Price” (EDLP) Walmart strategy?

Walmart’s EDLP strategy focuses on maintaining consistently low prices across a wide range of products. This approach builds customer loyalty, minimizes operational costs, and offers affordable options, including in-house brands like Great Value and Equate.

3. How much did Walmart’s third-quarter sales grow?

Walmart’s sales rose 5.5% to $169.59 billion in the third quarter, compared to $160.8 billion in the previous year. Comparable store sales in the U.S. grew by 5.3%, demonstrating strong performance across physical stores and digital platforms.

4. How did Walmart’s e-commerce sales perform?

Walmart’s global e-commerce sales rose by 27% in the third quarter, outperforming its 21% growth in the first and second quarters.

5. What role does consumer spending play in Walmart’s growth?

Despite inflation and constrained household budgets, consumer spending remained robust. Walmart capitalized on the holiday shopping season and provided affordable shopping options, driving its success in both physical and digital sales.

About The Author

Business

The Legal Landscape of Big Tech Antitrust Cases: From Google to Facebook and Amazon

The US Department of Justice (DoJ) has more antitrust cases in the pipeline to help the big tech giants get the taste of their own medicine along with Google which is now undergoing another lawsuit over alleged monopoly as a search engine and in online ad industry.

The future of tech regulation is strengthened by such antitrust cases since the importance of these legal battles is determined by the manners the courts would regulate competition by limiting the market power of any particular firm. Every firm should have a fair chance, based on the market rules, to do business and equally face substantial repercussions if someone fails to do so.

This post aims to compare these cases and assess their impact on the Big Tech industry, particularly in relation to the lawsuit filed against Google. The cases would probe into antitrust case scenarios of Google, Facebook, and Amazon, focusing particularly on their roles in the ad exchange ecosystem and how they manage to sell ads.

Google’s Antitrust Case: Key Issues and Developments

Creating a monopoly does not help, which Google might have known, especially with the ongoing scrutiny from the Justice Department. The case alleged that Google publishes the ad and banners across various websites from which the firm keeps a considerable amount of compensation that should be going to the online publishers.

Google faces a monopoly case that has almost the same allegations, particularly concerning its advertising business and Google Ads. Recently, the judge ruled on some sanctions for reigning the tech giant against illegal monopoly as a search engine, emphasizing the need for fair competition in ad tech. The government held its framework for the tech giant and shaping its future strategies, which may be scrutinized in the upcoming antitrust trial as a federal judge ruled on related cases.

Also, to further amplify the consequences of the civil antitrust actions against major tech firms, including Facebook and Google. Google monopoly case, as it relates to the broader context of US antitrust actions., which is currently under scrutiny in a civil antitrust suit. The government put forward the proposal for Google to end agreements with Apple and Samsung for tracking certain consumer data to ensure its search engine operates fairly. The “behavioral and structural” remedies would ensure that Google does not leverage big data and use Chrome browser in a certain way, as highlighted in the antitrust suit against Google.

The potential implications on Google’s model, if it loses the anti-trust case, might be in the form of restructural actions resulting from regulatory remedies. The remedies might include fines, behavioral and tactical changes, or a thorough structural change to its business operations if it lost the trial.

Facebook (Meta) and Antitrust Scrutiny

Meta, formerly Facebook, is facing DoJ antitrust cases from the Federal Trade Commission (FTC) in the Eastern District of Virginia. Meta is requesting the DoJ to dismiss the lawsuit which was about Meta selling Instagram and WhatsApp to FTC. These apps were acquired in 2012 and 2014 respectively.

| Lawsuit/Investigation | Date Filed | Description |

|---|

| FTC Antitrust Lawsuit | December 9, 2020 | The Federal Trade Commission (FTC) filed a lawsuit accusing Facebook of anti-competitive practices, including acquiring Instagram and WhatsApp to neutralize threats to its monopoly. The FTC sought to break up Facebook by unwinding these acquisitions. |

| U.S. State AGs Antitrust Lawsuit | December 9, 2020 | Attorneys General from 48 states and territories also filed a parallel lawsuit against Facebook, alleging that its acquisitions of Instagram and WhatsApp stifled competition and harmed consumers. |

| European Union Antitrust Investigation | June 4, 2021 | The European Commission opened a formal investigation into Facebook’s use of advertising data from advertisers to compete with them in classified ads services. This case centered around Facebook Marketplace. |

| FTC Revised Antitrust Complaint | August 19, 2021 | After the initial lawsuit was dismissed, the FTC filed a revised complaint against Facebook, adding more details about its alleged monopoly power in personal social networking services. |

| UK Competition and Markets Authority Investigation | June 2021 | The UK’s competition watchdog launched an antitrust probe into Facebook’s practices related to its use of data and its impact on competition, particularly focusing on Facebook Marketplace and online advertising. |

| Germany’s FCO Investigation (Bundeskartellamt) | February 7, 2019 | Germany’s competition authority (FCO) imposed restrictions on Facebook’s data collection practices, claiming they violated consumer rights and reinforced its dominance in the social network market. |

The main idea behind the antitrust case was the acquisition making the competition stifle in the social media market, which a federal judge ruled was a violation of anti-competitive practices. On the contrary, Meta stated that since the FTC reviewed the deal years ago and allowed them to be closed, now revisiting them for the same purposes doesn’t justify the antitrust suit brought against Meta.

Facebook’s recent crisis in legal battles also involves data privacy concerns, similar to those raised in the antitrust suit against Google. Data privacy is taken extremely seriously in every country of the world. Facebook has faced antitrust cases several times, such as in 2011, 2013, 2015, thrice in 2018, and 2019, similar to the suit against Google for monopolizing digital advertising technologies.

Facebook’s cases are somewhat similar to Google’s cases since they both involve creating a clear-cut dominance in the internet world, particularly in the realm of ad tech. Gaining information about customers’ choices and preferences and then molding them in the form of suggestions of ads or user experience preferences on Facebook and Google pages seem to be a likewise strategy that both the tech giants are following.

A digital economy expert said that several antitrust cases come down to “how much influence the search giant wields on default settings on devices like phones and PCs,” a point that could be pivotal in the ongoing antitrust suit against Google. The arms that Google and Facebook have been causing regarding data privacy are far too stretched to be analyzed as a big picture, especially in light of billions of dollars in legal battles over civil antitrust issues.

Spreading false information that has hurt political purposes and setting new ranges for showing ads on Google pages have raised question marks for the protection of public health (ethically, professionally, and socially) and democracy. Everyone is in a constant battle to create content and gain users’ attention for as many likes, views, and followers which is raising eyebrows about public health.

Amazon Monopoly Allegations

In 2023, the Federal Trade Commission (FTC) and 17 state attorneys sued Amazon for maintaining an online retail monopoly and using a monopolistic approach to being a technological company. It was alleged that Amazon stopped rivals and sellers from decreasing their prices, overcharged sellers for doing so, a number of times have compromised on the quality of products, suppressed competition, and forced rivals from changing their prices against the main rivalry of Amazon.

It is one of those DoJ antitrust cases where third-party issues came on the front. Amazon grew to be a dominant force in the online retail industry but in doing so, Amazon suppressed its third-party vendors within their own marketplace. The antitrust case report came up with a wide range of remedies that were put on the table for Amazon, including splitting up business units and some guidelines about the mergers, as directed by the federal judge.

In the modern digital age, antitrust cases are soaring more than before. Five big-tech companies- Google, Microsoft, Apple, Facebook, and Amazon- make up a total of 22 percent of the S&P 500 index. With their growing market, the growing concerns of their monopolization have risen to the surface more evidently than before, prompting investigations by the Justice Department.

Google and Amazon both capitalize on two types of markets, being the only dominant players in their specific niche. One type of market is the customers who come on their platforms to search for goods and services. Others are those who want to sell their own products to these customers, and hence, want to reach out to more customers through these two big companies, leveraging their ad tech capabilities.

Amazon and Google, hence, know how to play around these strengths, which is a strong advantage of maintaining their monopoly in their markets, drawing scrutiny from federal judges. Also, the use of anti-competitive “big data” by these two giants is similar. Lawsuits against Google and Amazon comprise of the same accusations that the data-driven necessities of modern times are making it a competitive advantage for these two, as seen in the suit against Google.

Amazon hosts more than two million sellers and has access to their information; the same stands true for buyers who have made accounts by signing in to Amazon and entering their personal details when they are making a purchase. Google does the same since Google digital advertising uses the same foundations of big data. Therefore, the ongoing scrutiny of these tech giants highlights the critical need for regulatory frameworks that address monopolizing digital advertising technologies, particularly in the context of US antitrust laws. Google monopoly case rests upon the same idea of dominance in the context of a civil antitrust suit.

The Role of Antitrust Law in the Digital Age

The current antitrust framework needs more powerful foundations as it focuses only on consumer welfare. This welfare is measured by price only. However, the tech giants have moved to consider other factors when it comes to the online world.

The giants are offering free or low-cost goods and services which is making it harder for the antitrust firms to take into account the factors that have transformed with modernization. Google gives free search engine service and the use of its Gmail account to its users.

Facebook does the same while charging no fee for making friends and following someone on their accounts. It is more about generating revenue through these simple steps that these tech giants have clearly devised in contemporary times, which perfectly blend well with the customers’ needs, and the customers themselves might have not known about.

It is the mass advertising, sometimes, with the help of Google digital advertising, which is now causing trouble for the antitrust cases. They need to have a more wholesome picture and rethink the ways that could slash the dominance of the tech giants, including potential suits against Google.

Antitrust cases and their judges need to understand that it is not the products or services but the data generated by users of those services. Tech companies have unlimited control over this data which naturally gives them a matchless competitive advantage for cut-throat dominion in their respective areas of online business.

Platform monopolies vs. content monopolies

A proposed solution for the antitrust cases and DoJ could include an understanding of the difference between “platform monopolies” and “content monopolies”. Platform monopoly is what Google and Amazon are following while content monopoly is followed by Facebook and other streaming services, as evidenced by the recent civil antitrust suit against Google.

Very little literature research is present to comprehend the factors and methods that determine some marketplaces as a “platform monopoly”. However, certain elements could be implied regarding publishers and advertisers.

- Just like Google, a platform monopoly offers products that account for a significant share of the market for its users, often leveraging their position to sell ads effectively.

- The firm’s competitors are either few or none, particularly in the realm of Google Ads.

- To maintain its dominant market position, it regularly makes use of data related to the products, such as consumer data, to ensure its search engine remains competitive.

Similarly, “content monopolies” like Facebook and Netflix have generated fears that they have content from all over the world and are known to be the most trusted platforms for content, leading to discussions in the district court. No verified pieces of research are present to define a content monopoly under the Sherman Act.

However, from what is available on the internet these days and whatever is implied from the available data, it is hard to deny that content on Netflix is giving a major threat to Hollywood. It has the power to distribute as much content to its users at a fixed cost, while also utilizing its dominance in the ad exchange market as the default search engine.

The same strategy is adopted by Facebook. It can offer free use of the platform, sending friend requests, and free control of the user to like or unlike a page, but it knows where to set the boundaries in terms of default search functionalities.

Potential Outcomes and Industry Impacts

The antitrust cases against the mega companies do not certify that these firms would abide by the laws in the future, especially in light of the ongoing civil antitrust suit against Google. If a single company like Facebook could be alleged several times almost every single year, it does not authenticate that other giants could prevent themselves from doing it too, particularly with the second antitrust trial looming.

However, giving a message that antitrust laws do exist and are here to reign the horses of these tech giants is certainly required, especially in light of the recent antitrust suit filed by the Justice Department. Harvard Business Review published an article in 2023 that stated the intervention of antitrust laws is not useful enough to increase innovation among tech businesses or does not facilitate the meaningful creation of competition by hindering the formation of monopolies.

Additionally, the big tech companies would have prepared for potential legal defeats and soon would come up with ways to handle the consequences. It could include diversification or new business models that challenge Google’s dominance in the ad market. Again, the role of regulatory interventions remains the highlight of the entire scenario.

The regulatory interventions should not only emphasize restraining monopolies and ensuring healthy competition but they should take into account third-party benefits as well, particularly in the ad tech sector. Third-party players are focused more on efficacy than innovation, especially as they navigate the complexities of the ad exchange landscape and the implications of the second case. An improvement should be suggested but with moderation.

Wrapping Up

The big tech players, including Google, are leveraging new technologies each day, which seems to be an unstoppable process of innovation, raising concerns among publishers and advertisers about their reliance on Google Ads. The case of generative AI is one to be named. The policymakers need to be careful about the policy theory development and the continuous dominance of these companies in the technology sphere with their unremitting expansion as central players in the domestic arena which can easily play a prank on domestic policy domains.

Their emergence as state-like actors, even on a global stage, is giving a challenge to the traditional framework of antitrust laws, especially in cases against Google. This is where the policymakers need to shift their dynamics critically.

FAQs

Q: What is the main focus of the Google antitrust lawsuit?

A: The main focus of the Google antitrust lawsuit is on the company’s alleged monopolization of multiple digital markets, particularly in digital advertising and search engine services. The Department of Justice (DOJ) claims that Google has used its dominant position to stifle competition and maintain an unfair advantage in these sectors.

Q: Who filed the antitrust lawsuit against Google?

A: The antitrust lawsuit against Google was filed by the U.S. Department of Justice’s Antitrust Division. This lawsuit represents one of the biggest antitrust cases in recent history, with the DOJ aiming to vigorously enforce antitrust laws against tech giants.

Q: What are the potential consequences if Google loses the antitrust trial?

A: If Google loses the antitrust trial, it could face significant consequences. These may include being forced to break up parts of its business, paying substantial fines, or having to change its business practices. The outcome could reshape the digital ad market and impact Google’s dominance in the search engine industry.

Q: How does Google defend itself against the antitrust allegations?

A: Google says that its practices are not anticompetitive and that it operates in a highly competitive market. The company argues that its success is due to the quality of its products and services, not unfair practices. Google’s defense team, including high-level executives, maintains that the company’s dominance is a result of consumer preference and innovation.

Q: What role does Judge Leonie Brinkema play in the Google antitrust trial?

A: Judge Leonie Brinkema presides over the Google antitrust trial. Her role is crucial in overseeing the proceedings, making key rulings on evidence and arguments presented by both sides, and ultimately deciding the case if it goes to a bench trial rather than a jury trial.

Q: How might the outcome of this antitrust trial affect other big tech companies?

A: The outcome of Google’s antitrust trial could have far-reaching implications for other big tech companies. If the DOJ succeeds, it may embolden regulators to pursue similar cases against other tech giants, potentially reshaping the entire tech industry landscape. Companies like Facebook, Amazon, and Apple are likely watching the case closely.

Q: What is the significance of the digital advertising market in this antitrust case?

A: The digital advertising market is a central focus of the antitrust case against Google. The DOJ alleges that Google has monopolized this market, using its dominant position to manipulate ad auctions and prices. The billions of dollars Google earns from digital advertising are at stake, and the case could significantly impact how online advertising operates in the future.

Q: How long is Google’s antitrust trial expected to last?

A: Google’s antitrust trial is expected to be a lengthy process. While the exact duration can vary, antitrust cases of this magnitude typically last several months to over a year. The complexity of the issues involved, the volume of evidence, and potential appeals could extend the timeline even further.

About The Author

Business

Google Antitrust Lawsuit And Its Effect On The Evolution Of Digital Advertising

Google antitrust lawsuit has created an intense discussion about whether Google’s dominance in the digital advertising industry would remain the same. Google is the biggest online advertiser with more than 27 percent of the revenue shared globally. It has beaten Meta by approximately $33 billion in the year 2024, further solidifying its position as a tech giant in the ad tech industry.

It could be inferred that this was Google’s most ignorant phase where it seemed to be enjoying its invincibility in the digital advertising industry and became ignorant somehow, started having hiccups with the unknown competitors. These are not search engine consoles or searchers built for online ads; rather, they are part of Google’s ad tech ecosystem.

These were the apps built for other purposes but they gained upon Google slowly to provide users a way to look for things that they would have otherwise searched on Google. TikTok, Facebook, Instagram, Quora, Reddit, Amazon, Walmart, Netflix, Hulu etc.

The post would explore how these platforms are disrupting Google’s model of online advertising and potentially challenging its monopoly.

Google’s current dominance in digital advertising

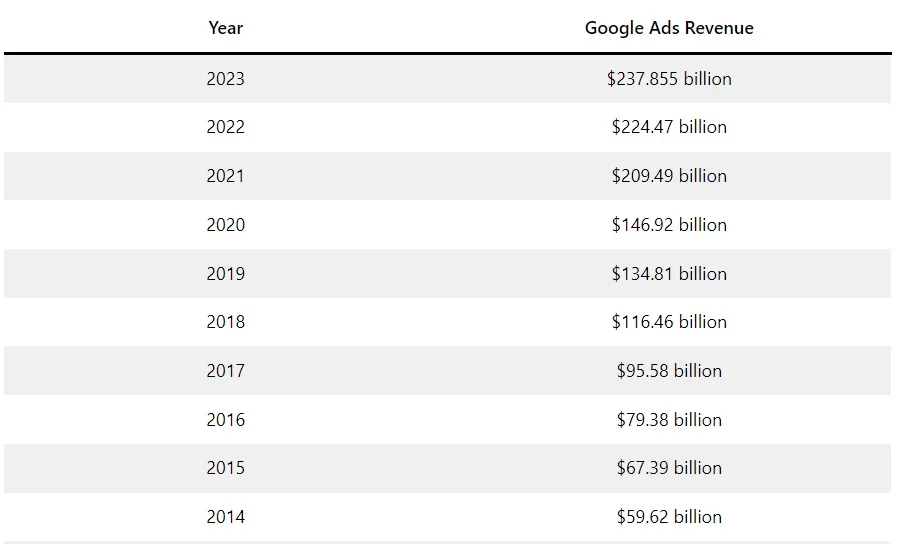

For 2023, the total ad revenue of Google was $224,473 billion, a significant figure in the debate over its alleged illegal monopoly in advertising technology and the ongoing antitrust violation discussions. which was more than that of the previous year, 2022 and 2021.

Google Ad Revenues in the light of the ongoing Google lawsuit are under examination by antitrust enforcers, emphasizing the challenges faced by the company.

The steady rate of increase for Google, which was 365.74 percent, has been observed which is a healthy sign for its ads business.

The top market share of Google online advertising remains a significant force, particularly as the antitrust case against Google unfolds. is coming from the pay-per-click (PPC) market, being 61.73 percent of the market share in the realm of search advertising, a figure that may be scrutinized in the antitrust case against Google.

For the customers, the results of the Google antitrust case could significantly impact the online advertising landscape. Google digital ads continue to be scrutinized under the lens of the ongoing antitrust suit, particularly whether Google is monopolizing the digital advertising market, leading to increased discussions among former Google employees. are always positive. 65 percent of the clicks are for buying keywords as compared to the organic results, which are only 35 percent.

Moreover, 75 percent of the users say that Google’s ads are informative and make their search easier in the context of the digital advertising market, which is crucial as Google faces scrutiny from antitrust enforcers. 43 percent of the users are inclined to buy the product when they see it running on Google digital ads, highlighting the effectiveness of search advertising.

Further stats from HubSpot and Lumio revealed that 58 percent of Millennials have made purchases through Google ads. Another 33 percent use Google ads on mobiles to increase their brand awareness via paid ads, a strategy that reflects the competitive nature of the ad platform market.

The shining results have come from Google’s advertising ecosystem, which includes AdSense, Adwords, Double Click, and its ad server technologies, despite the challenges posed by the former Google employees discussing the ad prices. Google Ad Manager, an ad server, is the current name for Google’s ad-serving platform which is perfect for users of Double Click for Publishers (DFP), especially as the company navigates the implications of the Google antitrust ruling.

The other effective tools that Google offers for marketers to help them grow with their ads are Google Keyword Planner, Google Analytics, Google Search Console, Google Business in the context of the Google antitrust suit is increasingly focused on the dynamics between publishers and advertisers. Profile, etc., is essential in the context of the Google antitrust ruling.

The rise of social media advertising

According to 2024 market stats, Facebook’s US ad revenues account for up to $33.68 billion in 2024, an estimate of 8.5 percent growth as compared to the previous year, indicating a shift in the ad platform dynamics. Facebook ads are considered to be one of the prime sources of its revenues, which is approximately 52.1 percent, highlighting its dominance as a tech giant in the digital advertising space.

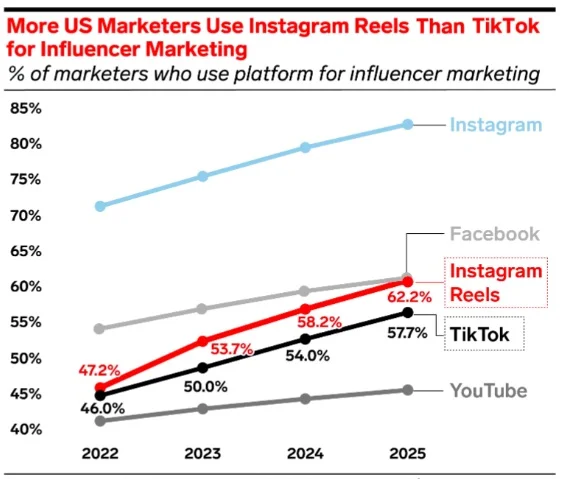

Instagram and TikTok reels are used for influencer marketers to generate ad revenues for these platforms, reflecting the broader trends in the digital advertising market. Almost 97 percent of the US influencers use Instagram for marketing purposes while 75 percent use Facebook for the same purpose.

As compared to Facebook, Instagram’s ad revenues in the US totaled up to $30.95 billion in the current year, which showed a 20.2 percent growth rate from the previous year, showcasing its strength in the ad tech sector.

Online product searches now take place on Facebook and Instagram as well. For example, when they have to search “office chairs”, they would go to Facebook buy and sell pages or directly to the Instagram search bar, utilizing various ad exchange platforms that are also being evaluated in the context of the ad tech antitrust trial.

Currently, Meta is number two, after Google when it comes to ad dominance, a situation that may change depending on the outcomes of the US antitrust investigations led by the DOJ’s antitrust division. However, Meta is losing its market share to Amazon, which is the biggest marketplace for products, raising concerns among regulators in the district court for the eastern district. The side ads on Amazon’s page also show suggestions once you have looked up a product, similar to strategies used in Google’s digital advertising market, which is currently under the scrutiny of the eastern district of Virginia.

A Forbes article of 2023 stated that the power of personalized ads cannot be ignored. People now prefer personalized and customized ads that would include user experiences and shopping behavior related to a product, which has implications for antitrust law discussions. In this way, online advertisers are able to create highly relevant and targeted ad campaigns for online navigators.

The same example applies to streaming platforms, such as Hulu. Once you stream a certain kind of content, it will suggest relevant ads to its customers. Moreover, Hulu charges as low as $500 for the advertisers to run their ads on the streaming platform, Forbes revealed, making it an attractive option in the competitive ad tech landscape.

One of the well-known ad campaigns for ALS (amyotrophic lateral sclerosis) research was run by the name “Ice Bucket Challenge”. The challenge was about people filming themselves when they were pouring ice water over their heads and throwing others the same challenge. It was shared on social media in 2014 and raised $115 million for ALS research, highlighting the power of viral campaigns in the ad platform landscape.

Why it became viral within no time, especially in a landscape influenced by the Google antitrust ruling? Because it was simple, included celebrities and influencers, such as Taylor Swift and Wendy Cheng aka Xiaxue (a Singaporean blogger and online TV personality), and had a measurable impact with a sense of accomplishment once completed.

The rationale for which advertisers are shifting budgets from Google to social media platforms is the use of sophisticated tools offered to advertisers, as they allege that Google maintains an illegal monopoly. However, it is mostly about where people spend most of their time, which is a key factor in the ongoing civil antitrust suit against Google. The visibility factor is high, and thus, ads are easily accessible to people.

Google online advertising needs to think of more viable ways in the presence of such tough competition, especially as the DOJ’s antitrust investigation unfolds. Google’s long-standing dominance is being challenged by a number of factors, including growing privacy concerns, technological breakthroughs in ad-blocking, the explosive growth of influencer marketing, and the development of artificial intelligence.

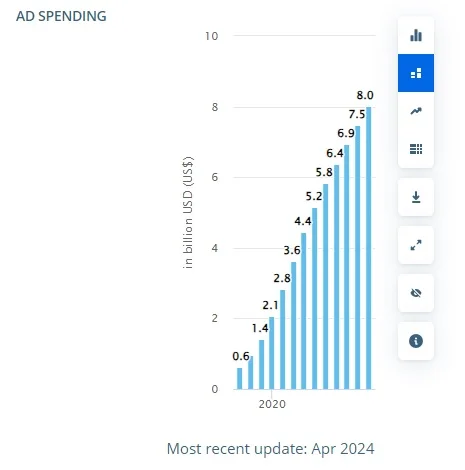

Streaming platforms as new ad giants

Viewers have switched to streaming subscriptions to Netflix, Hulu, and Amazon Prime to avoid ads while they are watching movies or shows on television. These platforms are now a huge market for online advertisers to gain leverage on, especially in light of the ongoing Google antitrust trial and the Justice Department’s scrutiny.

They provide a massive opportunity to engage viewers but with better versions of online ads. Some of them have tried using AI too. For instance, Hulu advertisers target ads to the users based on their age, gender, location, and interests which makes it easier for the publisher to position the ads well.

A similar strategy is used by Netflix where advertisers target some of the most popular content in the world to run their 10, 15, 20, 30, or 60-second ads, which could face scrutiny under the civil antitrust suit. The ads are related to dating services, financial services, etc., and are increasingly being analyzed in light of the US antitrust issues. It keeps in mind that romantic shows might be watched more by the age group 18-35, making it an effective targeting strategy and even memorable for online advertisers selling ads via Netflix.

Google Ads’ history starts from the 2000s, making it a significant player in the digital advertising market while maintaining its brand name and trust in the ad tech industry, despite the challenges posed by the antitrust case against Google. People are four times more likely to click on Google ads than any other platform ad. Google ads offer more visibility in the digital advertising market. and specialize in highly targeted campaigns that provide efficacy for the targeted users and their searched products through advanced ad auction strategies.

However, with aging Baby Boomers and Millennials, the new generations like Gen-Z and Gen-Alpha are shaping the way these younger people are searching for products online. They are more inclined to use social media platforms for checking out reviews and looking for web pages of the products, reflecting the changing dynamics in the ad exchange market amid the Google antitrust trial. Also, these generations use more streaming platforms like Netflix and Hulu which is raising serious questions on Google’s authority and market position in the online ad industry.

Challenges Google is facing

Google lawsuit argued that the US district court is narrowly focusing on the actual issue of Google digital ads and is not taking into account the true scale of the online ad industry’s competition.

Mark Israel, an economist, explained on behalf of Google that the judge is solely focusing on “open web display advertising”, which is a term for ads that show on web pages when Google is open on desktops and laptops.

He was of the view that online advertising has shifted its interest to social media platforms lately. For the year 2022, Google had only a 10 percent market share in the US for search advertising, which went down from the 15 percent that was set a decade ago, prompting scrutiny from the department of justice.

Israel again tried to stress the fact that the judge, Judge Leonie Brinkema, was only talking about Google’s inflating prices for the online ad runners and publishers in the ongoing Google antitrust case. The allegations revealed that Google keeps 36 cents on one dollar for each ad while having 91 percent of the control, over the publisher’s ad to itself, a focal point in the antitrust trial.

Israel denied the fact and asked the judge to take into account Google’s accuracy in matching the ads to the consumer, for which the price setting is done right amidst such intense competition in the presence of social media platforms.

As the proceedings of the Google antitrust case were conducted, Israel also clarified that recently, Google’s charges have dropped to 31 or 32 percent from the day the company noticed competitors charging high rates for the same task. Yet, the industry average for these charges is 42 cents per dollar for online ads of the publishers.

The complaint filed against Google is about the complex programming that Google uses for advertising including the bidding and targeting system that helps determine how the online ads are bought and sold. The allegations became stronger as Google made acquisitions to waive off the competition and maintain its hold in the said market as well as its supply chain.

According to the judge, Google uses its unchallenged authority in the digital ad ecosystem, bidding on behalf of the advertisers for the sake of owning the platform itself, a matter of interest for the justice department. In this way, Google makes more money and the publishers make less.

Google responded to the judge that the company is struggling against the more “messy and competitive space” now which includes The Trade Desk, Facebook, Amazon, TikTok, and Netflix. The third-party exchanges and the existing degree of interoperability have become more time-consuming and backbreaking work, raising concerns in the ongoing antitrust trial. As a result, Google clarified that it could otherwise produce adverse effects for the advertisers in the form of “invalid traffic and brand-safety risks”.

The future of digital advertising

A LinkedIn article published in 2024 gave insights into the way social media is becoming the “king of advertising”. More than 5 billion people on the entire planet use social media these days, which is 61 percent of the world’s population.

An estimated 19 percent of a firm’s advertising budget now goes into social media ads, which is almost equal to TV ad spending, highlighting the shift towards digital and Google ad tech. Hence, the growing influence of social media and streaming in the ad market is evident.

The complexity of Google’s antitrust case is more conspicuous with the incoming AR (augmented reality) advertising, as it complicates the landscape for Google ad tech. It is a form of digital marketing that makes use of AR/VR technology for interactive and engaging consumer experiences. For example, Teads partnered with Marcolin on an AR campaign for GUESS eyewear that gave online users a “Try-on” feature, showcasing innovative ad platform strategies.

Google antitrust case puts further questions on Google’s next strategy for online ad market and how Google should proceed upon it in the future to stay competitive. With the dynamic nature of the internet and its users’ needs, Google could rely on trial-and-error strategies and see which tactics work the best.

Wrapping Up

Google antitrust impeachment is an example that there comes a time for any giant tech company in the world when it is tested hard on the strategies that have worked for them for decades. Google had been a dominant market player for the last three decades but now with constantly changing market variables, Google’s survival in the online ad industry is jeopardized.

However, there is always a potential for a more balanced competition as social media and streaming platforms continue to rise. There still remains a chance for Google to evolve and re-position itself.

FAQs

Q: What is the Google antitrust lawsuit about?

A: The Google antitrust dispute involves the U.S. Department of Justice suing Google for monopolizing the digital advertising market. It accuses Google of controlling ad prices and limiting competition among advertisers and publishers.

Q: How does the antitrust trial affect advertisers?

A: The antitrust trial may impact advertisers by potentially lowering ad prices and increasing competition in the digital advertising industry. If the court finds in favor of the plaintiffs, it could lead to changes in how Google operates its ad tech tools.

Q: What are the main allegations against Google in this antitrust case?

A: The main allegations against Google include violating antitrust laws by maintaining a monopoly over the technology used to buy and sell ads. The lawsuit claims that Google has created a system that disadvantages rival ad tech companies.

Q: What could be the consequences if Google loses the antitrust trial?

A: If Google loses the antitrust trial, it may face significant changes to its business practices, including potentially being forced to divest certain assets. This could lead to increased competition and lower ad prices in the digital advertising market.

Q: How does the Google antitrust ruling impact publishers?

A: A ruling against Google could positively impact publishers by allowing them to negotiate better ad deals and access a wider range of ad tech tools, thus enhancing their revenue potential in the digital advertising landscape.

Q: What has Google said regarding the antitrust allegations?

A: Google says that the allegations are unfounded and argues that it operates in a competitive environment where advertisers have numerous choices. Google maintains that its practices benefit both advertisers and consumers.

Q: Who is involved in the Google antitrust case besides Google?

A: The case involves the U.S. Department of Justice, which is leading the lawsuit, as well as various ad tech companies and competitors that have been affected by Google’s alleged monopolistic practices.

Q: What are the broader implications of this antitrust case for the digital advertising industry?

A: The broader implications include potential regulatory changes that could reshape the digital advertising landscape, affecting how companies use and sell ads. It may set a precedent for how tech giants are regulated in the future.

Q: How are ad prices expected to change if Google is found guilty of antitrust violations?

A: If Google is found guilty, competition could increase, leading to lower ad prices as advertisers would have more options and leverage in the market. This could create a more balanced environment for advertisers and publishers alike.

About The Author

Sports1 month ago

Sports1 month agoRonaldo MrBeast Collaboration: Fan Defeats Football Icon in Challenge, Wins $1 Million

Politics4 months ago

Politics4 months agoKamala Harris Raised $540 Million Since Her Presidential Campaign Started

Entertainment2 months ago

Entertainment2 months agoJay Z Backlash: What Sparked the Controversy?

Science4 months ago

Science4 months agoHow Do Rising Sea Levels Affect Us? An Escalated Threat To Our Future

Sports4 months ago

Sports4 months agoJannik Sinner Won The US Open 2024 After Beating Taylor Fritz

Technology1 month ago

Technology1 month agoElon Musk Donald Trump at SpaceX Launch Event: Trump as Special Guest at Sixth Starship Test Flight

Business4 months ago

Business4 months agoFord Cuts Back On Its Efforts For Diversity And Inclusion

Education4 months ago

Education4 months agoAI In Education: edYOU With Three Subscriptions Makes It Happen

Pingback: Google Antitrust Lawsuit: Effect On Evolution Of Digital Advertising

Pingback: The Legal Landscape of Big Tech Antitrust Cases: From Google